Considerations for Social Security Beneficiaries: 2025 Social Security Cola Increase

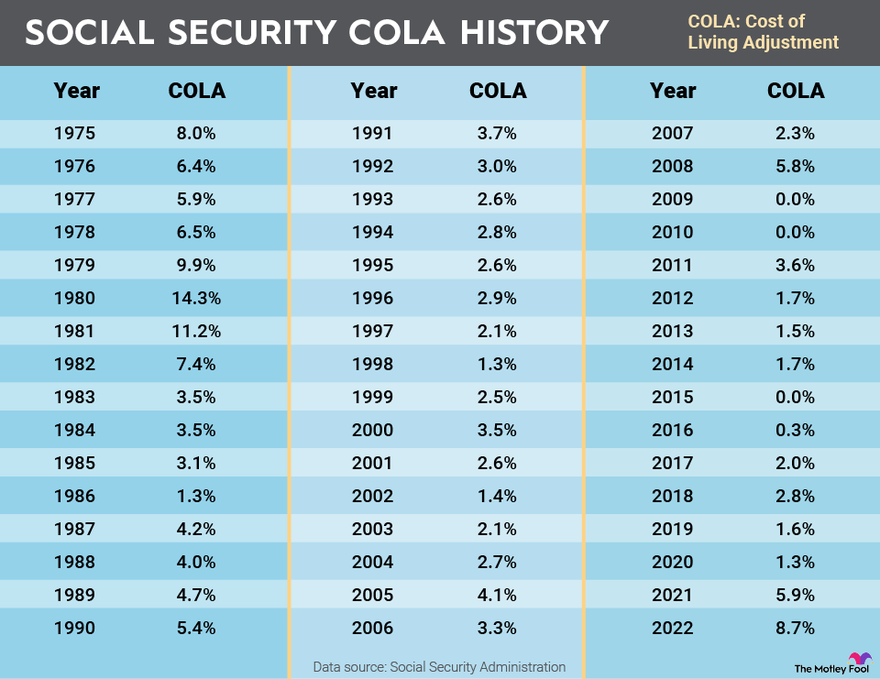

The projected increase in the cost of living adjustment (COLA) for Social Security benefits in 2025 presents both opportunities and challenges for beneficiaries. Understanding the potential impact of this increase and how to best utilize it is crucial for financial planning and well-being.

Maximizing the Benefits of the COLA Increase, 2025 social security cola increase

The COLA increase aims to help beneficiaries maintain their purchasing power in the face of inflation. To maximize the benefits of this increase, careful budgeting and financial planning are essential.

- Create a Budget: A detailed budget helps beneficiaries track their income and expenses, identifying areas where savings can be made. The COLA increase can be used to offset rising costs in essential areas like housing, food, and healthcare.

- Review Debt Obligations: The COLA increase can be used to pay down high-interest debt, such as credit card debt, freeing up more disposable income for other needs.

- Consider Savings and Investments: Part of the COLA increase can be allocated to savings or investments to build a financial safety net and secure future financial stability.

- Seek Professional Financial Advice: A financial advisor can provide personalized guidance on managing the COLA increase, taking into account individual circumstances and financial goals.

Potential Implications of the COLA Increase on Other Government Programs

The COLA increase can impact other government programs and benefits, such as Medicare.

- Medicare Premiums: The cost of Medicare premiums is often tied to the rate of inflation. An increase in the COLA could lead to higher Medicare premiums, offsetting some of the benefits of the COLA increase for beneficiaries.

- Other Government Benefits: Other government programs, such as Supplemental Security Income (SSI) and food stamps, may also see adjustments based on the COLA increase.

Long-Term Outlook for Social Security

The projected COLA increase highlights the ongoing challenges facing Social Security’s long-term sustainability.

- Trust Fund Projections: The Social Security trust fund is projected to be depleted by 2034. This means that benefits may need to be reduced if no action is taken to address the program’s long-term financing.

- Policy Options: Policymakers are considering various options to ensure Social Security’s sustainability, including raising the retirement age, increasing payroll taxes, or reducing benefits.

- Importance of Planning: Beneficiaries should stay informed about policy discussions and plan for potential changes to Social Security benefits in the future.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is still up in the air, leaving many retirees wondering if they’ll be able to afford their next cup of coffee, let alone a new Chicco chair table seat for their grandkids. Hopefully, the COLA will be generous enough to keep up with the rising cost of everything, including those adorable little chairs that help toddlers conquer mealtime.

Fingers crossed!

Who needs a 2025 Social Security cola increase when you could be riding the wave of the future? Forget those measly pennies, ripple xrp is the real deal, a digital gold rush waiting to happen. Maybe then we’ll all be so rich, we won’t need that measly Social Security check after all!